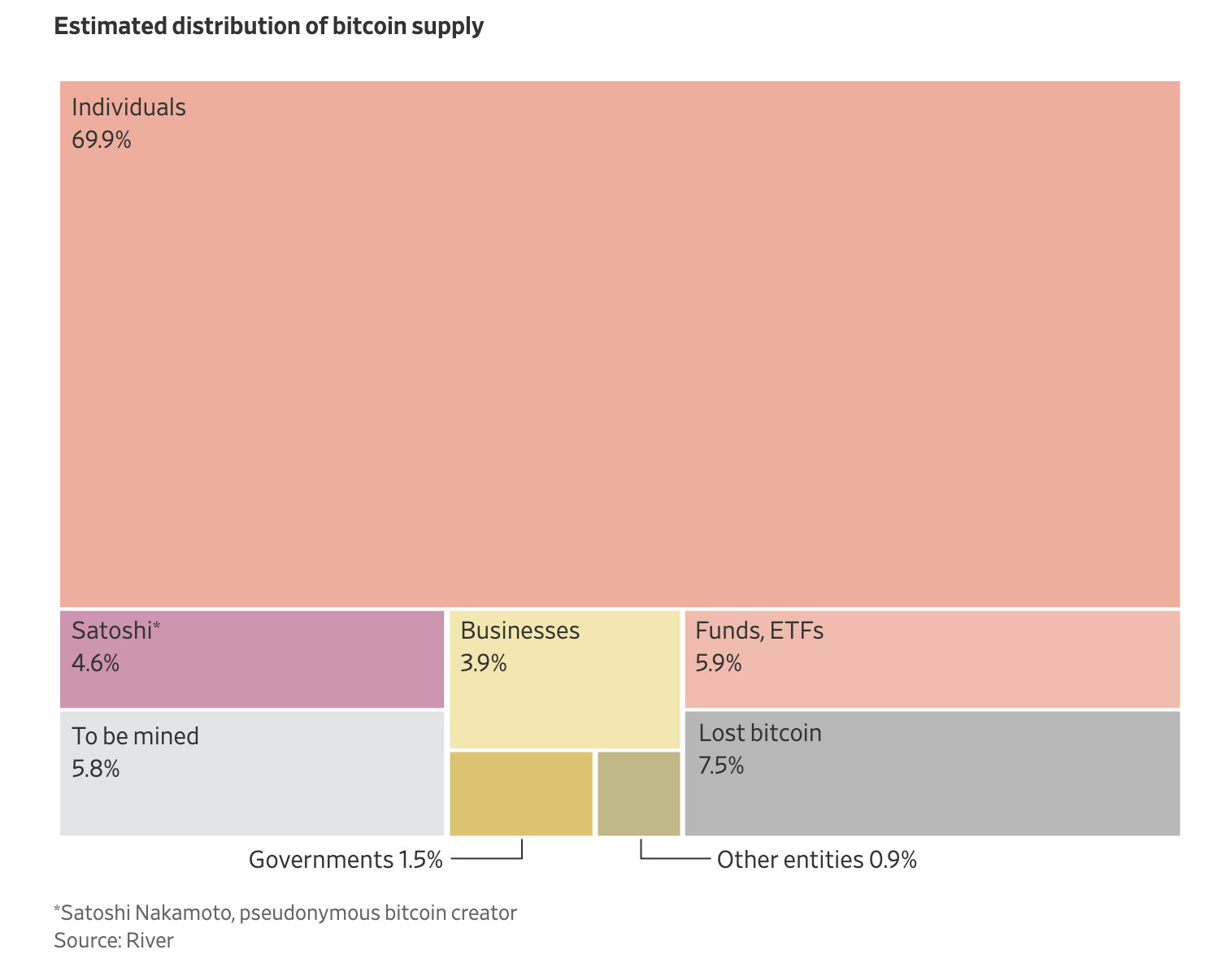

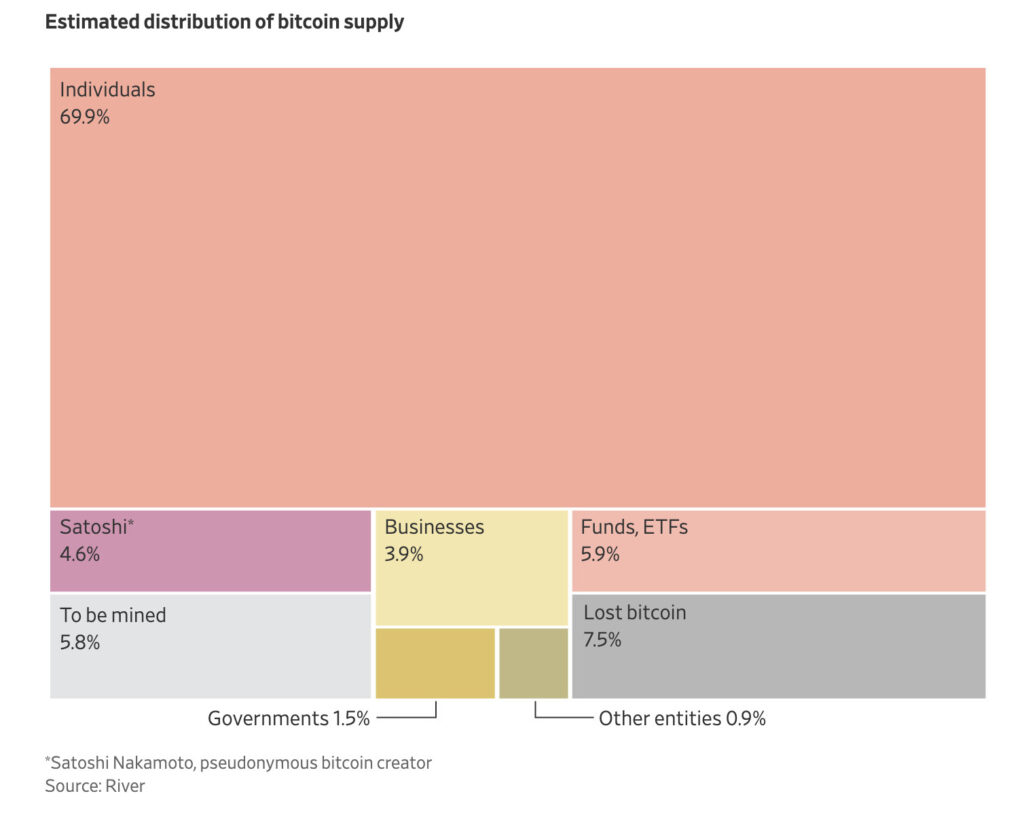

The following article talks about the limited supply of BTC and how it affects the price but of particular interest is the following graph showing the Bitcoin Supply Distribution

The link to the full article in the Wall Street Journal is here but some of the key takeaways from the article are

- The computer code behind bitcoin imposes a hard cap of 21 million bitcoins. So far, about 19.8 million bitcoins have been created, and it will take more than a century to create the rest, a process that will become increasingly difficult over time

- Proponents of bitcoin argue that its scarcity will fuel rising prices as buyers scramble to acquire the last new coins to come online, or to buy existing coins from people fortunate enough to own bitcoin already

- Skeptics counter that bitcoin has no intrinsic value and that a wave of selling could wipe out its recent gains

- To create new bitcoins, bitcoin miners use computers to solve complex mathematical puzzles and are rewarded with new units of the cryptocurrency. The size of the rewards is cut in half roughly every four years. Eventually the rewards will dwindle to nothing

- For one thing, more than 1.5 million bitcoins worth around $150 billion have been lost, according to estimates by River, a bitcoin brokerage

- River estimates that some 14.7 million bitcoins—or about 70% of the ultimate supply—is held by individual investors

- In recent years, big institutions have amassed a growing slice of the bitcoin supply. This includes public companies such as MicroStrategy and Tesla

Finally this, “For too long our government has violated the cardinal rule that every bitcoiner knows by heart: Never sell your bitcoin,” Trump said in July